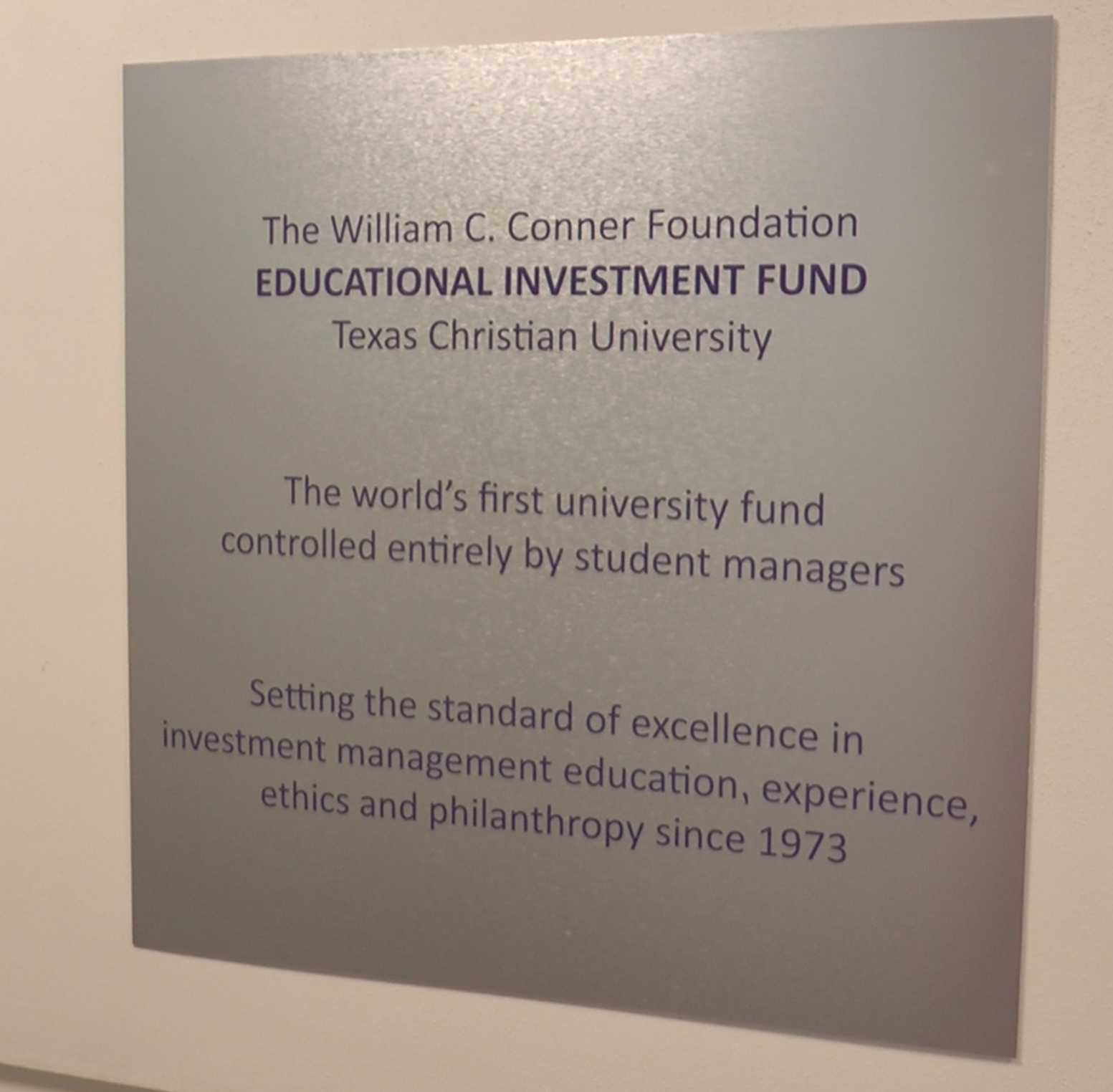

TCU’s Educational Investment Fund (EIF) offers select students the chance to use one million dollars to gain real world experience.

Founded 44 years ago by William C. Conner, EIF is the first ever student-run investment fund using Conner’s initial $600-thousand dollar donation to invest in the stock market. Since its founding, EIF has had profits of about $3.7 million.

“We’ve distributed just over three million dollars to our benefactors, TCU and the Baylor School of Ophthalmology,” said EIF Chief Administrator Jared Cline.

EIF is a non-profit and Analyst Rachel Fikse says their growth is a reflection of the money that is not donated.

“We initially started out with a million and now we have a million three,” Fikse said. “That’s just because we give a majority of the profits to charities and so we’ve retained some of the profits over the years, but we give a majority away.”

The students in EIF are entirely responsible for investing that $1.3 million in the stock market.

Each student covers two stocks and is responsible for building a financial model, writing a report and dictating whether the group holds, buys or sells the stocks they report on.

Currently, EIF holds 31 stocks – such as Apple Inc. and Facebook – and two bond funds. For a more detailed list of EIF’s investments, see their annual report below:

TCU EIF 2016 Annual Report by Kat Matthews on Scribd

EIF Chief Administrator Jared Cline oversees the group throughout the year as they gather information about their fund’s performances for the year.

Cline said, “It talks about the investments decisions that we made, it goes through the investments that we currently hold as of year end. And since we are a non-profit foundation we’re audited, so it includes the audit report and our financial statements for the year end.”

This year EIF is focusing on technology and that drove the group to sell their Oracle stock.

“Everything in the future with technology is about cloud computing,” Fikse said. “Basically Oracle was lagging behind in the cloud computing sector and they’ve been buying a lot of companies and doing a lot of acquisitions, but they haven’t been doing any organic growth from within the company itself.”

Fikse said the real world experience she received from the fund is one of the coolest parts about it.

“It’s really hard, but definitely the most rewarding program I’ve ever been in,” Fikse said. “I feel like I’m teaching myself everything and I feel like everything I’m learning is something I’m going to use in my real job.”

The benefits of the real world experience are one thing EIF students all agreed on.

“EIF offers a hands-on investing experience that lets you transition some of the finance topics that you learn about in class to a real world, real money, giving back to TCU type of situation,” Cline said.

The program, Fikse said, is catered toward finance, accounting and economic majors. The program is a two-semester commitment and can be either summer-fall or fall-spring.

Previous years reports and instructions to apply can be found on the EIF website.

The group is accepting applications for the 2017-2018 season and anyone interested can find the application here.